The short answer is that yes, Wise is definitely one of the cheapest, safest ways to transfer money. And if your current alternative is to use your regular bank, then for once trust a stranger on the internet and go right ahead and open your Wise account. You can use this link, which may or may not be an affiliate one (it is), but this article is entirely based on my experience as a satisfied customer. Now, if it takes you a little more to trust the word of a stranger on the Internet, let me lay it out for you.

Table of Contents

What is Wise?

Or to answer the opposite question, what is not Wise? Wise is not a bank, but a “financial technology company” launched in 2011, their website explains. At this point, you may wonder “Is Wise secure?”. Worry not, your money is safe with them: Wise is licensed to hold funds and follow strict regulations. Unlike banks, they don’t lend your money but safeguard it separately. They keep a significant portion in secure assets and hold cash in reputable banks, ensuring availability even during market fluctuations. This approach ensures that your money is safe.

What is Wise multi-currency account?

Wise also offers some pretty sweet bank-like services like a really cheap debit card that is perfect for traveling (more on that in a future article) and bank accounts. The subtlety, compared to your regular bank, is that instead of a one-currency pretty regular, pretty ordinary, pretty boring account, you can technically open accounts in 40 different currencies, all visible at one glance in your Wise app (although you may need a fair amount of scrolling right if you do have 40 currency accounts. Needless to say that you can easily transfer money from one currency account to the other, only paying the cheap fee that Wise requires from you (I’m getting to that part).

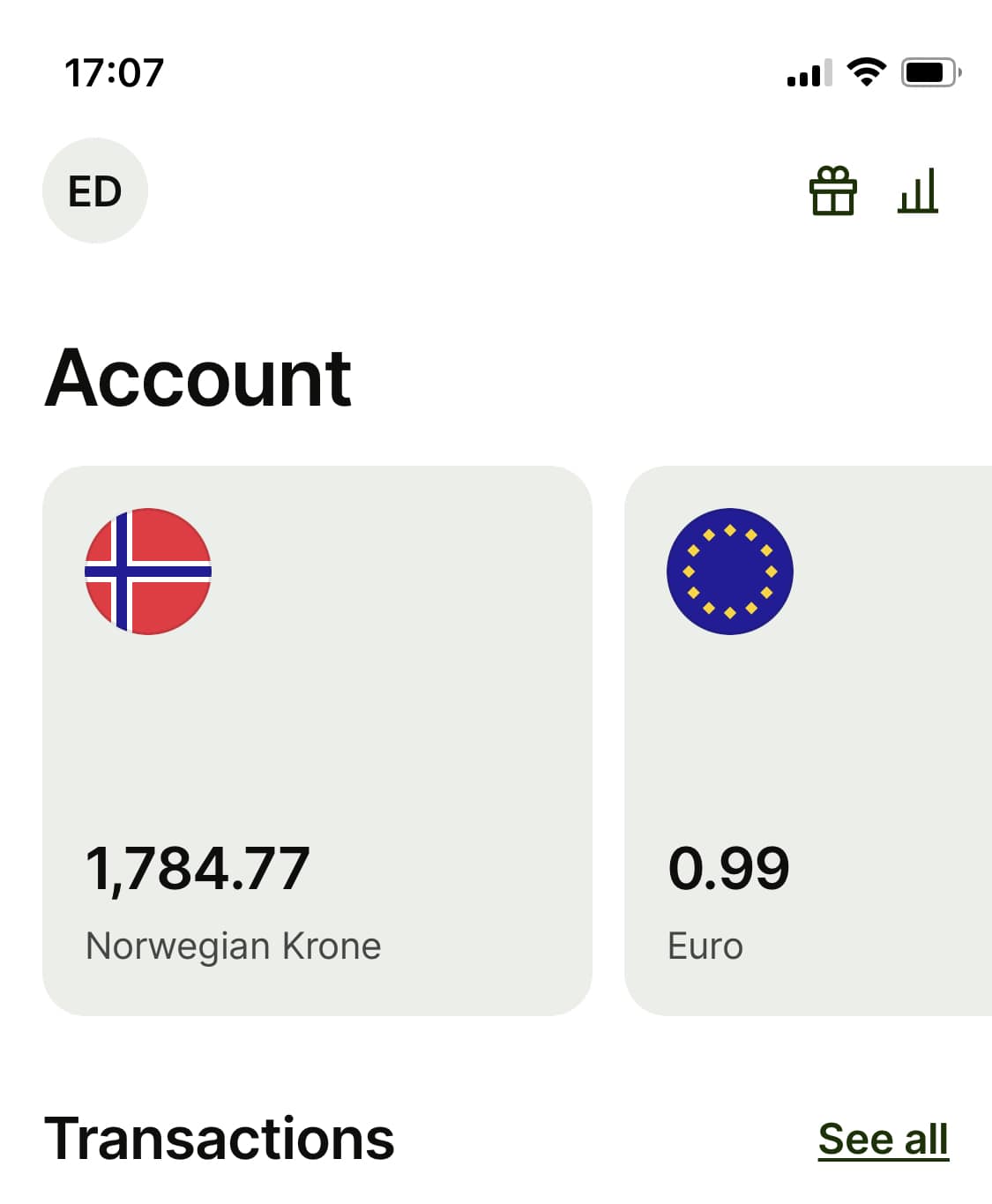

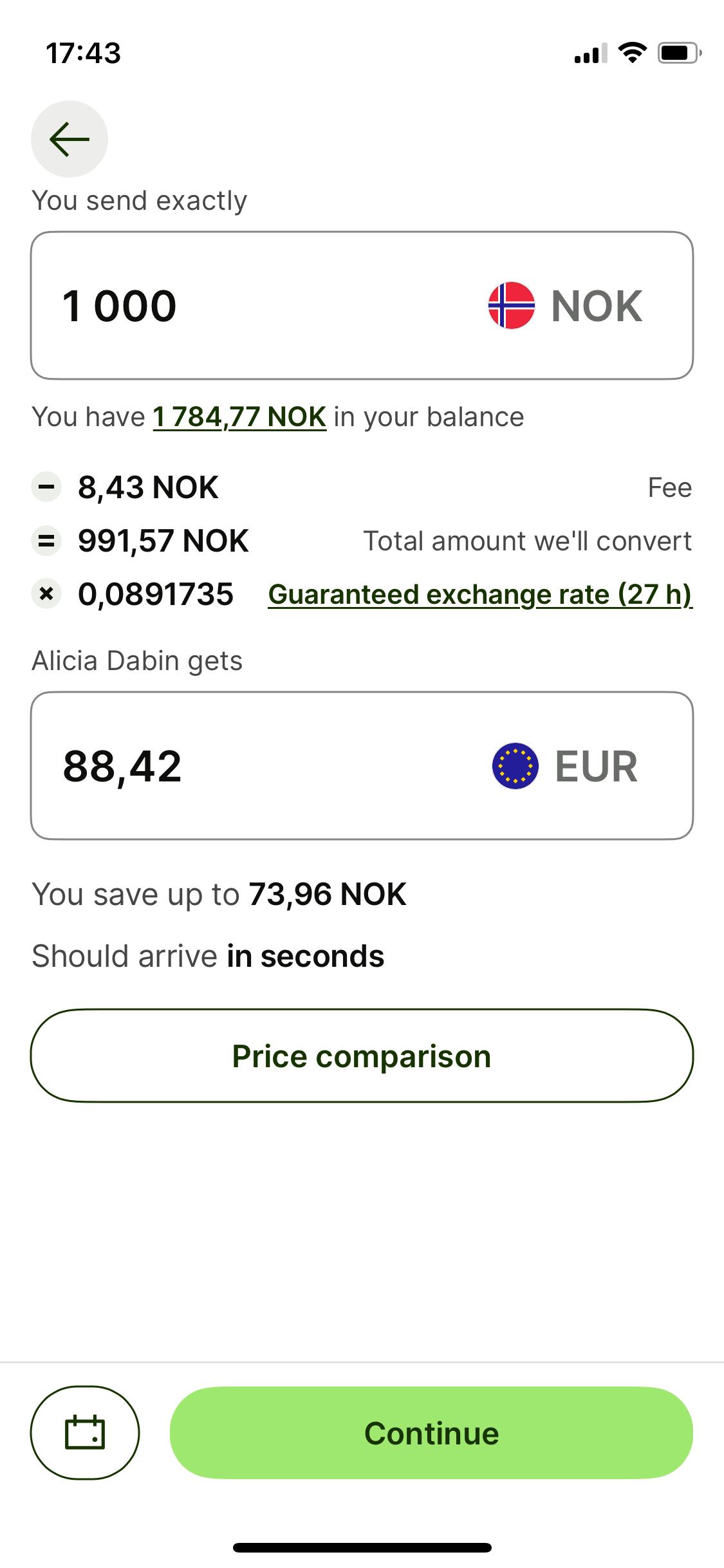

So in my case, when I open my Wise app, I can see my Norwegian money account and its 1784,77 NOK, right next to my Euro account containing a grand total of…0,99 €. If I scroll to the right, I can open more currency accounts, with just one tap of my finger. Shall I decide, as we speak, to “convert” 1000 NOK (88,75€) from my NOK to my euro account, Wise would take a payment of exactly…4,78 NOK (0,43 €). Pretty sweet, huh?

How does Wise work?

“How come this Wise thingy is so cheap?”, you might wonder. And I have too:

It is cheap because it is not a bank. End of story. Thanks for coming to my TED talk.

No, please stay. It is cheaper because Wise works differently from wires sent through your normal bank. Banks use the SWIFT network, which involves several intermediary banks passing a payment through a chain until it reaches its final destination. This takes time, and because intermediaries charge fees it’s also often expensive. So not only does the bank of origin charge you a lot (a quick look at the price list of my bank in Norway and of my parents in France, shows that they both charge at least 100 NOK/10 € each for sending money abroad), but your recipient may will also lose some money along the way, and it’s difficult to know exactly as much.

Meanwhile, Wise built its own payment network to avoid SWIFT, with local bank accounts around the world. When you convert money with Wise, you’re actually making a transfer to a same-country bank. Wise then matches the amount in the destination account, again, thanks to their local network. Technically, the money has never crossed the border, and that’s why Wise can keep the fees low.

Wise transfer fees

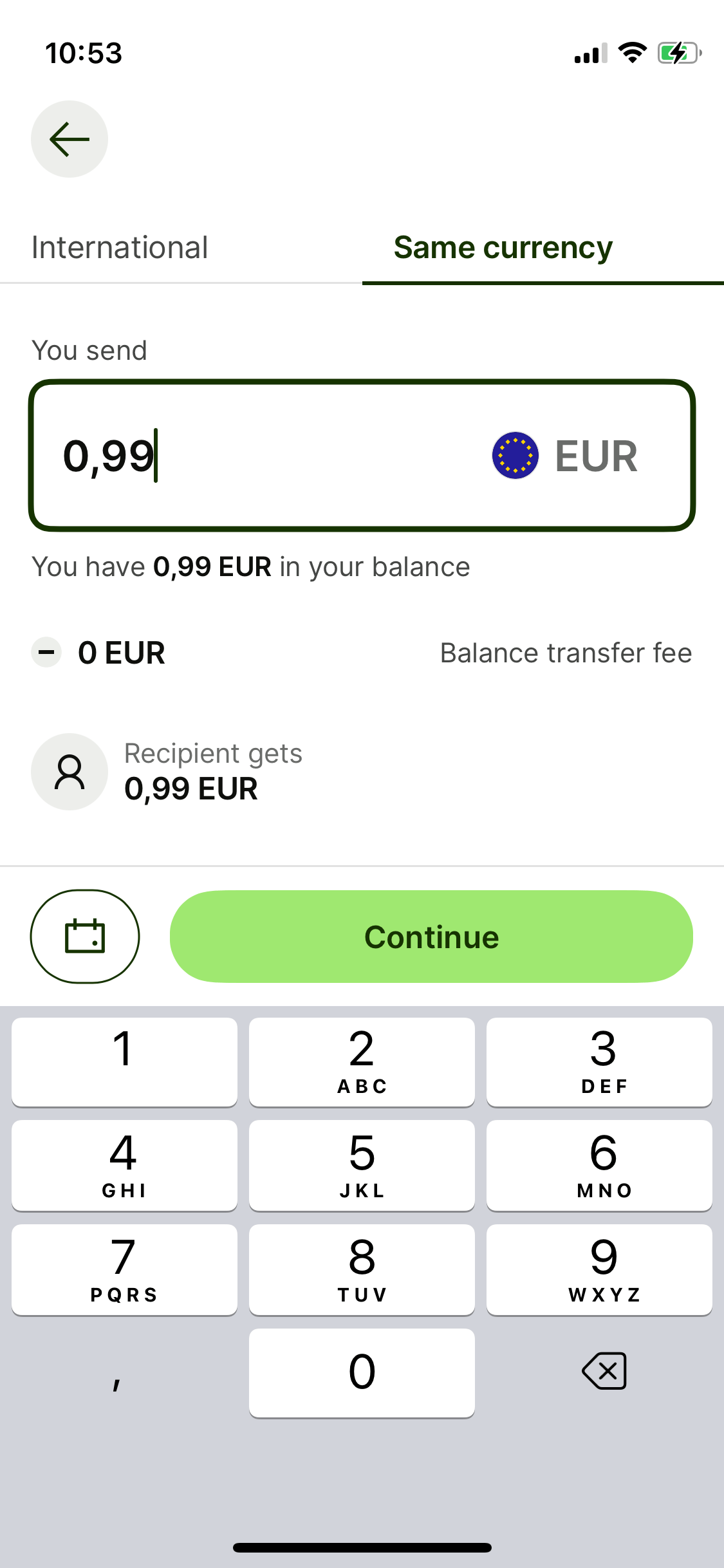

No fee for same-currency transfers

First of all, incoming and outgoing same-currency transfers are always free, whether they are from a Wise account to another, or from a regular bank account to a Wise account and vice versa. When I send money from my Norwegian bank to my NOK Wise account, I never pay anything. I wouldn’t pay anything either if I were to make a transfer from my € Wise account to a regular bank account in the Eurozone. Of course not! This is a same-currency transfer as well. Now the interesting part is how much it cost me to get my Norwegian money in my Euro account.

What goes into the total cost of a Wise transfer?

The cost of a transfer with Wise is determined by the amount you’re sending, your chosen payment method, and the exchange rate.

Upfront fees

The amount you transfer dictates how much you pay, as there is a minimum fee for small transfers. This seems to be around 3 NOK for transferring 3,41 NOK or 0,30 € for transferring 1,41 €. For more normal amounts a transfer costs “From 0,43%” of the amount varying by currency, according to Wise’s price list. If it doesn’t tell you much, the easiest is just to check out their fee calculator or to have a quick look at the table below. Note that an additional fee will be applied for specific types of transfers where you send € outside of Europe.

| From € to NOK | 1,41 € (minimum amount) | 10 € | 100 € | 1 000 € |

| Sending fee | 0,30 € | 0,35 € | 0,85 € | 5,86 € |

“Are the fees really that transparent?” you may ask. I was actually surprised to see that the fees are slightly different depending on if you send money directly to a foreign account, or if you convert it within your multi-currency accounts before doing a same-currency transfer. But it’s not necessarily a bad thing as I use that to my advantage (more about that here). However, I would still say that they are, in the sense that you can find out very easily how much a transfer is going to cost you, and that that cost is pretty much the same regardless of when you make the transfer if you exclude the rate exchange factor of course. The same cannot be said about Revolut.

Wise exchange rate

The exchange rate is obviously another factor that may impact how much ends up in the destination account, and here is another major difference between Wise and your regular bank:

When a financial institution offers a currency exchange to its customers, it often adjusts the exchange rate slightly in its favor by adding a markup. This markup represents the profit or fee that the institution charges for facilitating the currency conversion. Wise, on the other end, uses the mid-market exchange rate, which is the real-time rate at which currencies are traded on the global financial markets.

Whenever I transfer money to my family in France, I can see both the fees that I will pay Wise and the exchange rate used for the transfer, which on the pic on the right is “guaranteed” for 27 hours. And that’s what I like about Wise: no surprises. Whenever I purchase something online on a foreign website with my credit card, the amount tends to change (rarely in my favor) from the moment I make the purchase to the moment the money is debited. No such nonsense with Wise.

Payment method: slow and fast transfers

Last but not least, the “payment method” is really where you can keep the fees low, as Wise lets you choose between slow and cheap or fast and a tiny bit more expensive. While a fast transfer will arrive in seconds, you’re always better off going the slow way, which still arrives within the day, or the next day at worse. That being said, the “Fast and easy” transfer is indeed easier as you can literally be done with it in one click if you have Apple Pay/Google Pay.

The slow way requires you to open your normal bank app and make a transfer from there with the reference number provided by Wise. This applies to same-currency transfers as well. I already said it was free, but that is if you do a manual bank transfer. Going the fast way to add money to a currency account would cost you 4 NOK/0,47 € for a 1000 NOK/100 € transfer. And while that may not seem like much, I always choose the slow route as it’s one of the tricks to keep international transfers cheaper. More on that here.

>> Open your Wise account here <<

A cheaper way to transfer money: how to reduce Wise fees?

Some “hacks” are obvious and have already been covered: to keep it cheap, plan ahead and favor slow transfers. But here is something else I discovered while fiddling about in the app. Converting money is cheaper than sending it.

Convert from one currency to another

What does that even mean?! Well, “sending” would typically mean transferring from one currency to another, to someone else’s account. Once in a while, I send money to my French therapist, as payment for our sessions. I receive my salary in Norwegian crowns, and she takes payment in Euros, so I do have to send from one currency to another.

For the 55€ I owe her, I would have to pay a fee of 5 NOK (about 0,44 €) for sending money from my Norwegian bank. For some reason, the fee is slightly higher, 6,59 NOK, if I send that amount from my Wise NOK balance. However, if I were to add to my NOK Wise account, for free with a slow transfer, and then convert from my Wise NOK balance to my € balance, the fee is only 3 NOK. It seems like the difference between these three ways to transfer evens out for higher sums, but if you need to do small transfers regularly, think about it! Also, once you have money in the app, converting to another currency is instant.

| From NOK to € | 3,41 NOK (minimum amount) | 100 NOK | 1 000 NOK | 10 000 NOK |

| Fees when “sending” | 3,29 NOK | 3,79 NOK | 8,45 NOK | 55 NOK |

| Fees when “converting” | 0,02 NOK | 0,48 NOK | 4,78 NOK | 47,77 NOK |

Use the Wise auto conversion

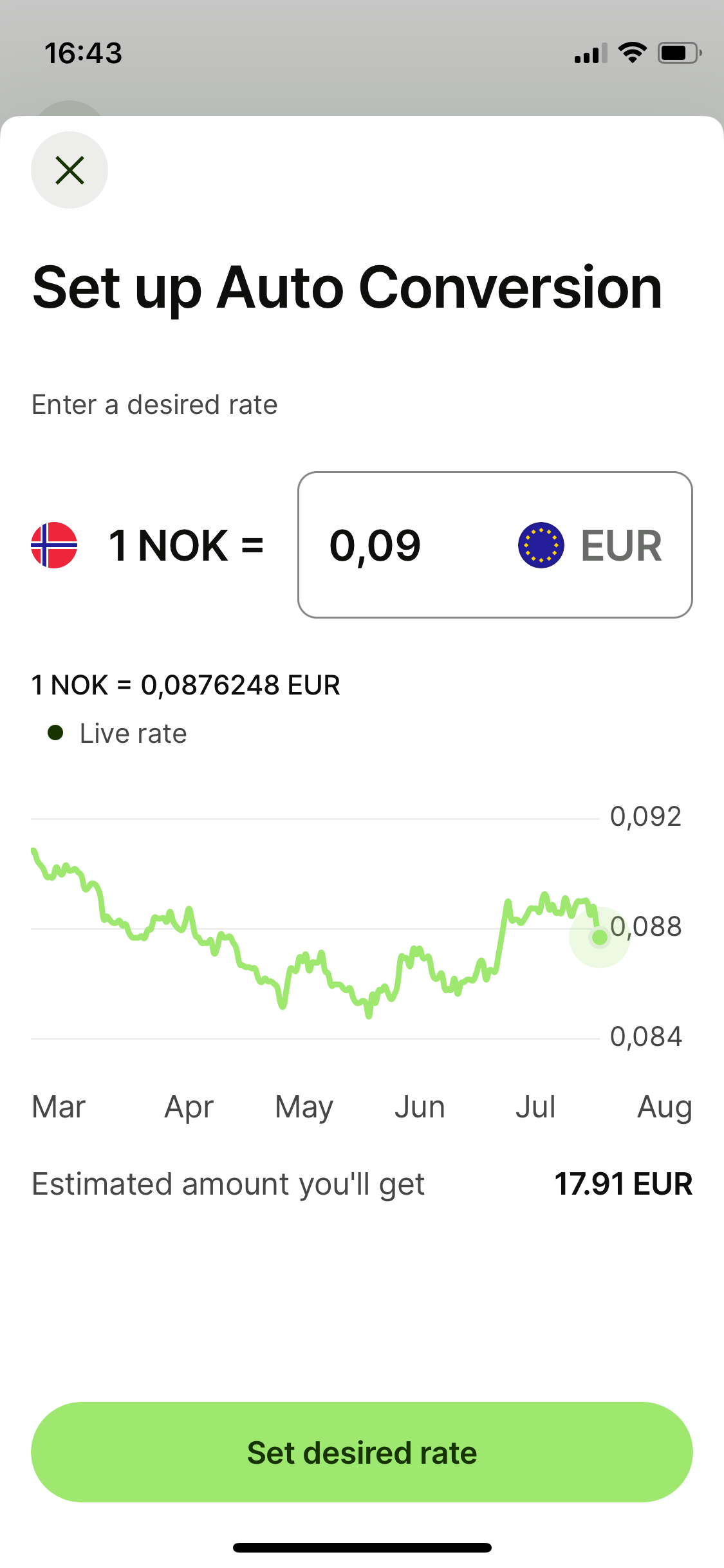

I believe this feature is rather new, as I’ve only noticed it recently. If you’re not in a rush to get your euros or other currency, this hack is perfect for you. You see when you try to convert or send money, there is a little toggle switch at the bottom, labeled “auto conversion“. It is by default greyed out, but should you choose to activate it you will be offered, on the next screen, to set a desired exchange rate. What it means is that your transfer will only be made once the favorable mid-market exchange rate is reached. This way, you can secure a bigger amount on the receiving end. Of course, if you’re too greedy and the desired rate never happens within two weeks, the auto-conversion and the transfer will be canceled.

Keep your “moneys” separated

Finally, another way to not have to pay transfer fees is… don’t transfer. Hear me out.

If you are an expat like me, you probably happen to receive some € or other currency while visiting your country: relatives pay you back for activities you were the one to book, payment by Flightright or other as compensation for that flight where you got stranded, donation by parents, or that grandmother who always slips you a 20 (but the digital version of that). While these Euros/dollars may not serve you once you “come home”, they will at some point: next time you visit, or for euros, for any vacation in the eurozone, and even online shopping. My tip, keep these euros in your Wise euro balance. If you’re my target group and happen to live in Norway, believe me, you will be better off not having to transfer these back later from a weak NOK.

Wise vs Revolut vs Paypal

When I started to write this Wise review I took my homework seriously, and I was planning on writing about Revolut vs Wise, Paypal vs Wise and maybe some other financial service company. But the truth is, only one of these companies comes close to Wise, with comparable prices when it comes to international transfers.

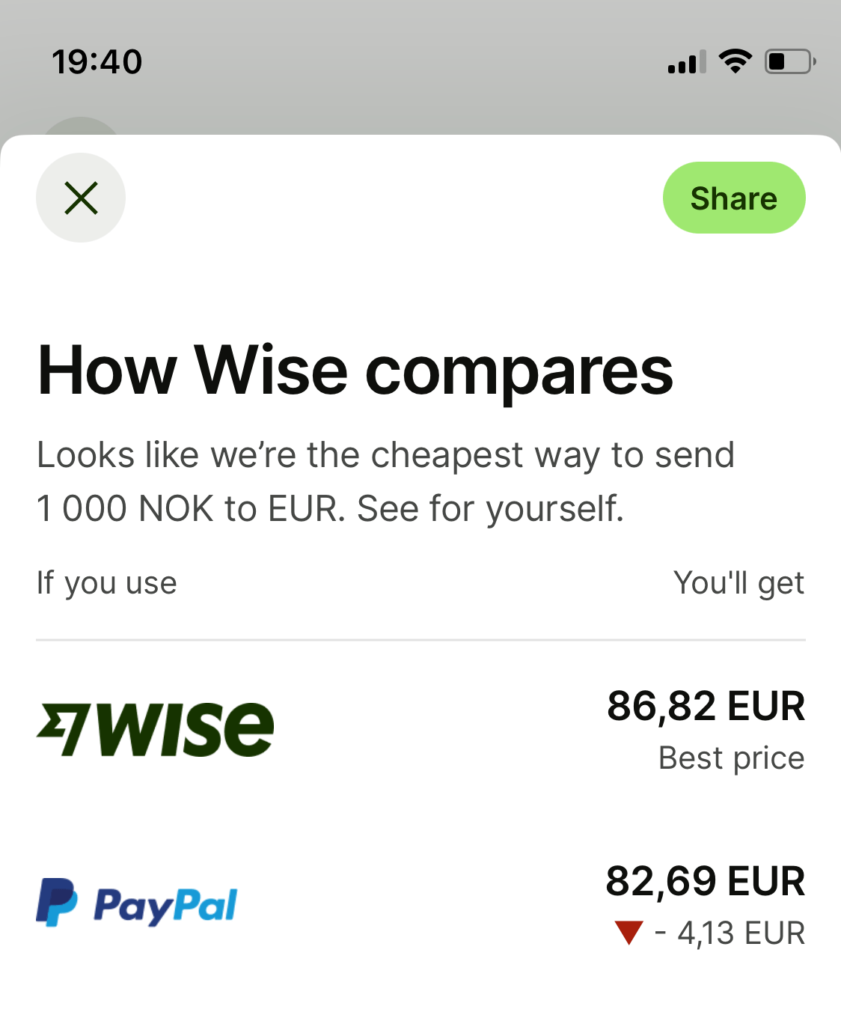

Real quick about Paypal vs Wise

Get this: if you were sending 100€ directly to another PayPal account, you’d face a fee of 5%, which would amount to 5€, with a minimum fee of 1,99€ regardless of the amount. Additionally, if you chose to fund the transfer using a credit card, the 2.9% fee plus the fixed fee would contribute to the overall cost. And if currency conversion was necessary, a 4.5% fee would apply, impacting the total cost of the international transaction, whereas as we said, Wise only uses the mid-market rate with no markup. In other words, moving on! Wise is the clear winner (source: Paypal).

Revolut or Wise, Wise or Revolut?

Aaand we’re finally getting to the meat of this. Revolut is possibly Wise’s only real competitor when it comes to international transfers, something I gathered from hanging out on Facebook expat groups. So what did this girl do last Friday evening when she was too lazy to write this blog post? She checked out Revolut’s website and app to figure out if the fuss was equally deserved.

Revolut transfer fees

To put it this way, my first, second, and third impression, is that Revolut could well be cheaper than Wise, sometimes, but I wish their fees were more transparent and easier to understand. Some things were pretty clear though:

- Revolut has several subscription plans that give you a certain number of advantages. You can get a free plan called “Standard plan”. Compare plans here.

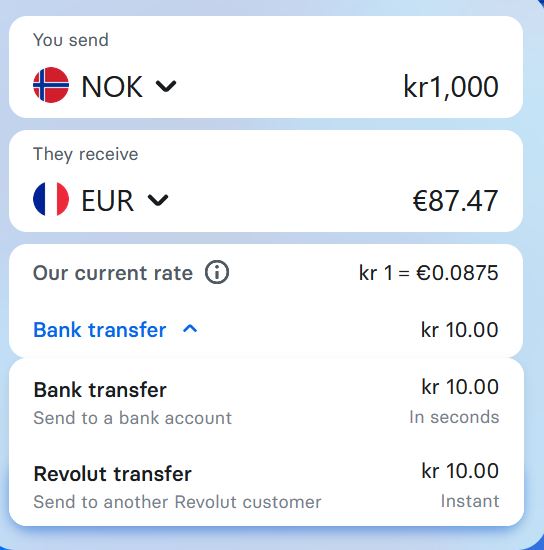

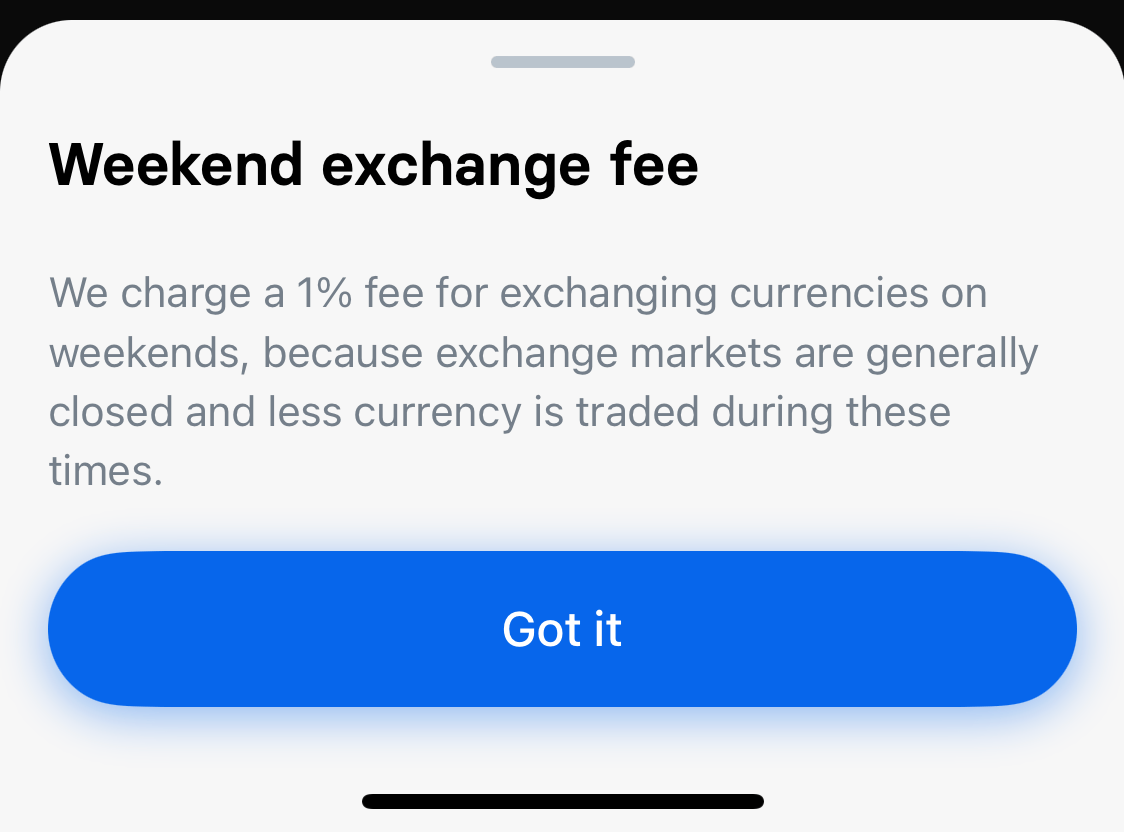

- No matter what, it will cost you more money to transfer with Revolut on the weekend. Here is a screenshot from Sunday, where a 1000 NOK transfer to Euros would have cost me 10 NOK. The same transfer on Wise costs 4,7 NOK.

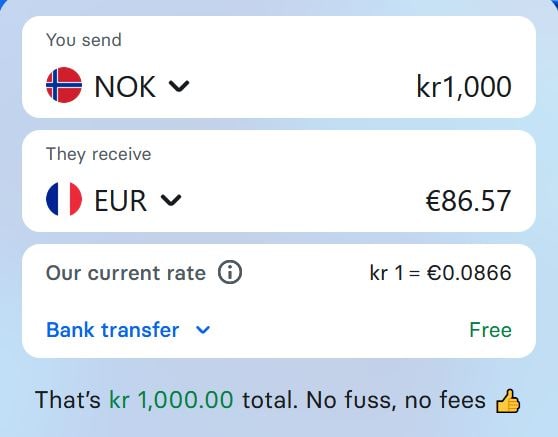

Other than that I got quite confused by their pricing, because Revolut’s fee page states that “a fee applies for international payments“. And yet here is what I could see on Friday and this morning, as I was faking it (faking transferring money that is): “FREE“. Which made me wonder if the fee was baked into the exchange rate, or if the receiver would get the entire amount.

How does Revolut work?

After raking my brain out and doing extensive reading on Revolut’s fee page and plan comparison page, here is how I think it works:

- a fee indeed applies on all international transfers, and it is a fee on the exchange rate. Depending on your plan you’re fee exempted within a specific limit, which is 1000£ for the standard plan, but this is a combined limit that includes “Currency, Crypto, and Commodities” (Source).

- The fee exemption does not apply on the weekends.

- If you exceed the 1000£ limit, Revolut will charge an additional fee of 1% for Standard customers, in addition to regular fees and weekend fees.

- I assume the regular fees are for specific types of transfers, like Wire transfers in the US, which are, by the way, cheaper with Wise.

- If you have a paid subscription plan, you get a discount on Revolut’s additional fee above the 1000£ limit.

What I’m still confused about

Something that still bugs me though, after reading the fee page, is that I’m still not 100% sure the receiver gets all of the money. Indeed, Revolut mentions a “Pay All Fees feature [that] allows you to pay a flat upfront fee which guarantees that the recipient receives the full amount. This will be charged instead of the standard international payment fee.” I have so far not seen this “Pay all fees” anywhere. Does this mean my receiver would have to pay some fees, or is it because I am still well under the fair usage limit? And does it mean I am going to have to transfer 1000£ to find it out? 😮

A last detail that also makes me a little bit unsure is, still from the fee page about the exchange rate and fee, “Where possible, we will tell you the total cost before you make the exchange.” Revolut, do you mean you won’t always be able to tell me the total cost and my receiver won’t get the entire amount?!

Wise vs Revolut: it’s a tie

Alright, alright, I feel I vented enough about my unfulfilled expectations of Revolut. The truth is, I have to admit that Wise is not always cheaper. How could it be when the opposing part offers transfers that are, in theory, free? My takeaway is that as long as you transfer during the week, and you stay within the fair usage limit, Revolut is going to be the winner. So I’m probably going to start using it as well, if anything just to test it. I might come back with a Revolut review in a few months. I also want to talk more about Revolut and Wise’s debit cards in the future.

Despite that, I can still only recommend Wise, as their transfer fees are still extremely low, and very transparent. I have trusted Wise from the start and I am not there yet with Revolut, we need to get to know each other better.

>> Open your Wise account here <<

Conclusion

Wise has few real competitors when it comes to international transfer. It may not always be the cheapest, but it comes very close, and sometimes it actually is. One thing I really appreciate, other than saving me tons of money, is its transparency. I already know exactly what I’m gonna pay, and how much the person I’m transferring money to will receive, so it is still my chosen platform for international transfers. If I’ve convinced you, give it a try and check out transfer fees or open your account here.